Q2 2022 Crypto Portfolio Allocations

I was inspired by the Merit Circle monthly treasury reports to share my own crypto portfolio allocations. Although I’m not a big DAO with venture capital funds, I like the idea of transparency and building in the open.

I previously shared my Axie Infinity adventures and numbers in my Axie Journal series. I enjoyed hearing from readers and responding to their emails. The goal is the same with this post. I want to get feedback on my portfolio. And to hopefully help others think through their holdings.

This essay is not financial advice and intended for informational and entertainment purposes only.

Portfolio Overview

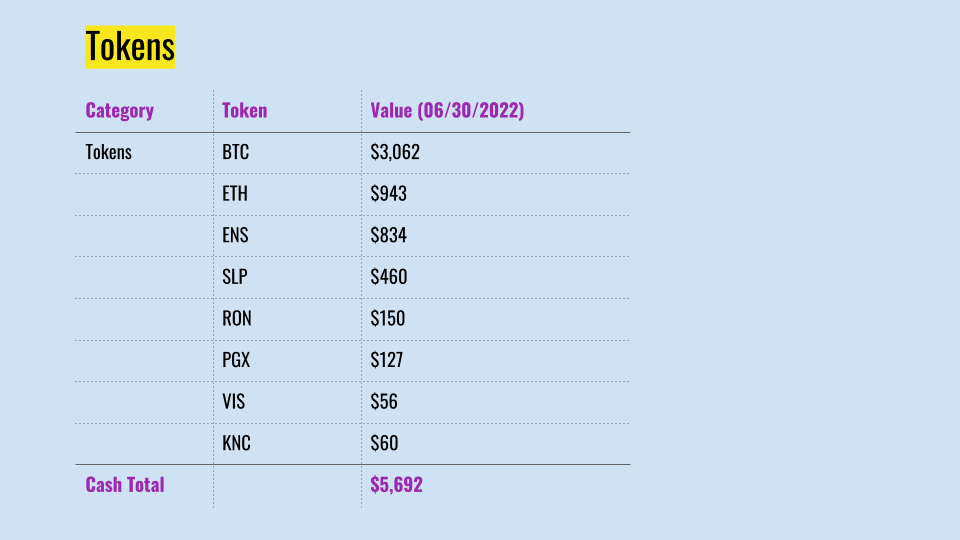

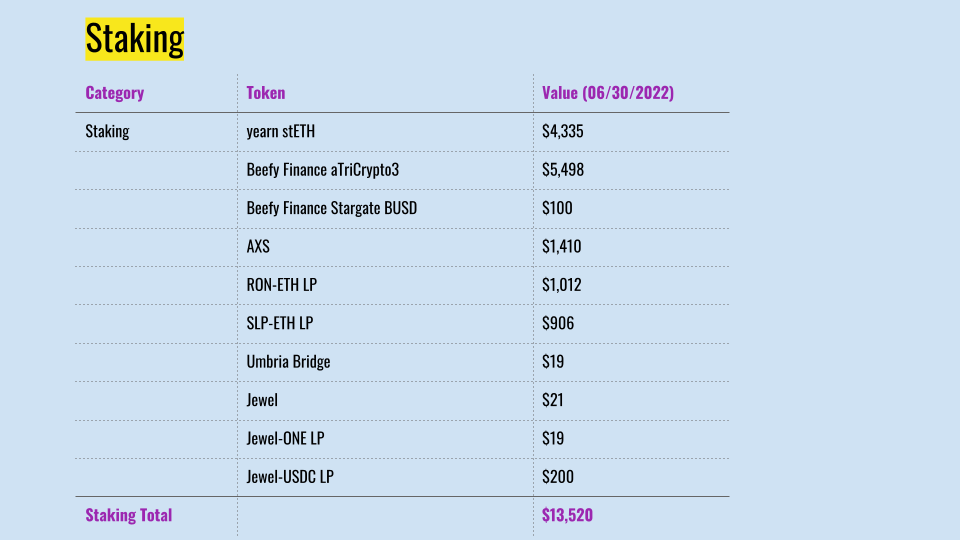

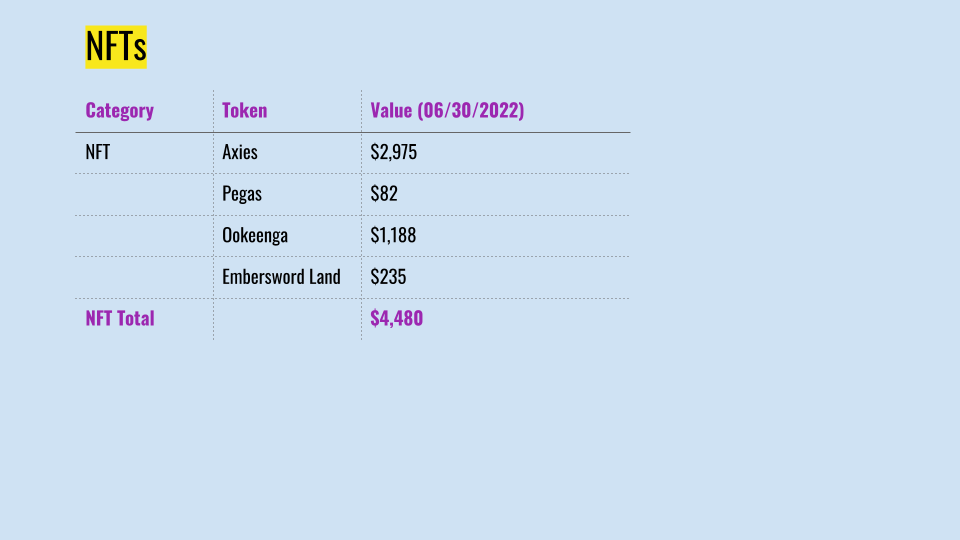

Total value of crypto holdings is $22,169 as of June 30th, 2022.

Q2 Activities

CeFi Cash Out

I moved all my assets out of Centralized Finance (CeFi) in June. I had a significant portion of my holdings on BlockFi and Gemini. I was attracted to the high interest rates for stablecoins, ETH, and BTC.

However, the bankruptcies of Celsius and Three Arrows Capital spooked me. The high interest rates were not worth the risk of having my assets frozen. I pulled out all my tokens into a hardware wallet. I also cashed out my stablecoins into a traditional savings account.

DeFi Yields

But I am not completely risk averse. I still want to earn yield on my cryptocurrency. Therefore, I turned to Decentralized Finance (DeFi).

I contributed to the aTriCrypto3 liquidity pool (LP) on Curve. This pool holds BTC, ETH, and the big three stablecoins (USDC, DAI, and Tether) in an equal ratio. I felt this pool was relatively safe due to its high marketcap. I get exposure to bedrock cryptocurrencies with a modest yield.

I also staked some of my ETH on Lido. The upcoming Merge will transform the Ethereum blockchain form proof of work (PoW) to proof of stake (PoS). In a PoS blockchain, users can deposit their tokens to help secure the blockchain. As a reward for doing this, the users earn additional tokens. This is similar to the mining rewards in a PoW consensus model.

To participate as a validator and earn rewards, users have to stake 32 ETH. However, I don’t have that much of ETH sitting around. Fortunately, there are staking pools that allow users to participate with any amount of ETH. Lido is one of the those staking pools. Since I was going to hold ETH anyways, I might as well earn yield on it.

Fails

The market downturn hit my portfolio hard.

I invested in Pegaxy with holdings in PGX, VIS, and Pegas. The values of these assets came tumbling down in the beginning of Q2. The overwhelming demand for Pegas finally died down. The game economy could not sustain itself when no new money came in. So the bubble popped.

Defi Kingdoms (DFK) followed a similar fate but due to different reasons. Harmony, the blockchain that DFK lives on, was hacked for $100 million. So prices of assets were depegged because they were no longer backed on other blockchains. Jewel, the game’s main token is now worth $0.20 from a previous high of $20.

Lastly, but most famously, is the LUNA crash. I invested in LUNA’s stablecoin, Terra USD (UST). I was lured by the high yields without the cryptocurrency swings. Basically treating it as a supercharged savings account. This was obviously the wrong line of thinking.

I should have sold my UST when I first heard the news but was confident that it would find its peg. I could have lost just 15% of my investment but instead ended up losing all of it.

I think about this loss the most, even though it’s not my biggest loss. It’s the perception that I could have done something to prevent this. I remember staring at CoinGecko when the new broke, asking myself whether or not I should exit at 70 cents on the dollar.

The lesson learned is perfectly summarized in this tweet by Haralabos Voulgaris:

— Haralabos Voulgaris (@haralabob) June 21, 2022

Plans for Q3

Axie

Land staking was released on June 30th. The yields look attractive based on the current price of land and AXS. I plan to liquidate some of my LP tokens to purchase a plot of land. I think the long term value of land will outpace the value of the tokens in my liquidity pools (SLP, ETH and RON). I believe it’s an easy call, especially paired with the yields from staking land.

DFK

There are currently no good solutions for getting back the assets from the Harmony bridge hack. As a result, the value of 1USDC on Harmony to USDC on other chains is about 1 to 9. This is worrying and I have lost confidence in the Harmony blockchain. I plan to move all my DFK assets to Crystalvale on the DFK side chain.

I also plan to buy a Hero and explore quests. I have banked quite a bit of Jewel from the gardens. I want to see what’s in the actual game beyond just getting yield for providing liquidity and staking.

ETH and BTC dollar cost averaging

I have been buying small amounts of ETH and BTC every month. I believe in web3. If cryptocurrencies are the future, then ETH and BTC will be a part of it. I will continue to dollar cost average into both tokens.

TL;DR

- Total value of my cryptocurrency portfolio at the end of Q2 2022 is $22,169

- $5,682 in tokens

- $13,520 in staking

- $4,480 in NFTs

- Q2 Activities

- Moved all my assets out of CeFi

- Moved it into yield generating protocols in DeFi

- Lost money with Pegaxy, Defi Kingdoms, and Terra USD

- Q3 Plans

- Buy a plot of land in Axie Infinity

- Move DFK assets out of Harmony and into DFK Chain

- Continue buying ETH and BTC

Tags: #crypto